Key points

- Advised baby boomers are more prepared to meet their spending needs in retirement relative to non-advised peers.

- Most UK baby boomers are not on track to maintain their current lifestyle in retirement.

- A dynamic spending approach that offers short term spending stability while guarding against premature portfolio depletion can help clients navigate the decumulation phase of life.

Wealthy baby boomers1 who sought the help of a financial adviser within the past 12 months are more prepared to meet their spending goals in retirement, according to new research by Vanguard on the UK’s retirement readiness.

The Vanguard Retirement Outlook: Assessing the retirement readiness of UK baby boomers found that only 40% to 50% of the generation are on track to maintain their current lifestyle or achieve a moderate standard of living in retirement. Middle-income baby boomers (those earning between £32,600 and £46,599) were found to be particularly unprepared.

Wealthier baby boomers (those with a net worth of £250,000 or more) are more prepared for retirement than less wealthy individuals. Yet, among the wealthier cohort, those that had not received financial advice were less prepared across three measures of retirement readiness:

- Their target replacement rate (TRR), which refers to the Pensions Commission’s2 estimate for the percentage of pre-retirement income an individual needs to maintain their current lifestyle in retirement. This ranges from 86% for low-income individuals to 72% for middle-income individuals and 50% for high-income individuals.

- The Pensions and Lifetime Savings Association’s (PLSA’s) ‘moderate’ retirement living standard (RLS)3, which calculates that a single person would need a pre-tax spending budget of about £36,000 per year for a moderate lifestyle, rising to £47,600 for a couple.

- The PLSA’s ‘comfortable’ RLS, which states that an individual would need an annual pre-tax budget of £50,900 for a comfortable lifestyle in retirement, rising to £67,500 for a couple.

Advised wealthy baby boomers are more prepared for retirement

Subgroup |

Percentage on track to meet their target replacement rate | Percentage on track to meet their Moderate RLS | Percentage on track to meet their Comfortable RLS |

|---|---|---|---|

| Advised | 83% | 90% | 83% |

| Not Advised | 74% | 83% | 68% |

Notes: This analysis focuses on baby boomers with net wealth greater than £250,000, resulting in a sample of 134 individuals. Net wealth is the sum of DC pension, personal pension and net financial wealth as defined by the ONS. We assess retirement readiness against target replacement rates and the Moderate and Comfortable Retirement Living Standards. 'Advised' denotes individuals who reported seeking professional financial advice in the last 12 months, 'Not Advised' represents the results for those who did not report seeking advice. Median net wealth of the sample is £433,000, while median income is £61,000.

Sources: Vanguard calculations, based on data from the Office of National Statistics’ Wealth and Assets Survey (Round 7). Pensions Commission’s target replacement rates, with gross earnings band thresholds uprated by the Resolution Foundation. Pensions and Lifetime Savings Association calculations of Retirement Living Standards.

It’s important to acknowledge that wealthier individuals are more likely to seek financial advice and have sufficient resources to meet their retirement spending goals. As a result, we can’t explicitly link financial advice and retirement readiness, as the direction of causality cannot be determined.

That said, Vanguard’s Adviser’s Alpha research, which seeks to quantify the value of advisory services to investors, suggests advisers can add significant value to their clients’ long-term financial outcomes through non-portfolio-related tasks, including tax-efficient retirement strategies, asset location and behavioural coaching.

Deliver value with a sustainable withdrawal strategy

Retirement is a significant and, in some cases, complex life event that is a common trigger for an individual or couple to seek the help of a financial adviser. Beyond helping clients build and manage their wealth efficiently in the run up to retirement, advisers can also deliver significant value by helping individuals navigate their spending in retirement with a sustainable withdrawal strategy.

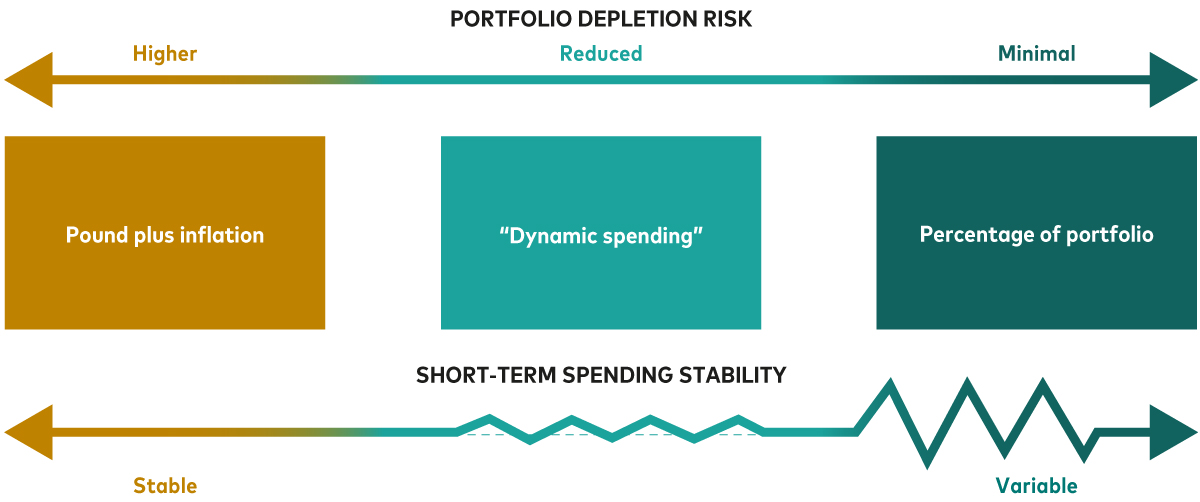

Traditional spending strategies, including the ‘pound-plus-inflation’ and ‘percentage-of-portfolio’ rules, are popular with advised and non-advised retirees, but also come with some drawbacks, including the risk of sacrificing real spending stability or depleting the portfolio prematurely.

For the right client, Vanguard’s Advisory Research Centre proposes a hybrid, ‘dynamic spending’ strategy that targets inflation adjustments to spending, but with guardrails in place (a ceiling and a floor on expenditure) reflecting market performance as well. The graphic below provides a high-level summary of the pros and cons of the three retirement spending approaches.

Balancing portfolio depletion risk with short-term spending stability

Source: Vanguard.

How does dynamic spending work?

Dynamic spending works by modestly adjusting an individual’s withdrawal amount in response to portfolio performance and inflation each year. The first step is to set an initial withdrawal rate – much like the pound-plus-inflation approach. The next step is to set guardrails around this initial amount to help smooth annual spending budgets from one year to the next. For example, you might apply a 5% ‘ceiling’ and a -2.5% ‘floor’ that allows for short-term spending stability while also guarding against portfolio depletion.

Our research shows that dynamic spending can offer an attractive balance between short-term spending stability and reduced risk of portfolio depletion.

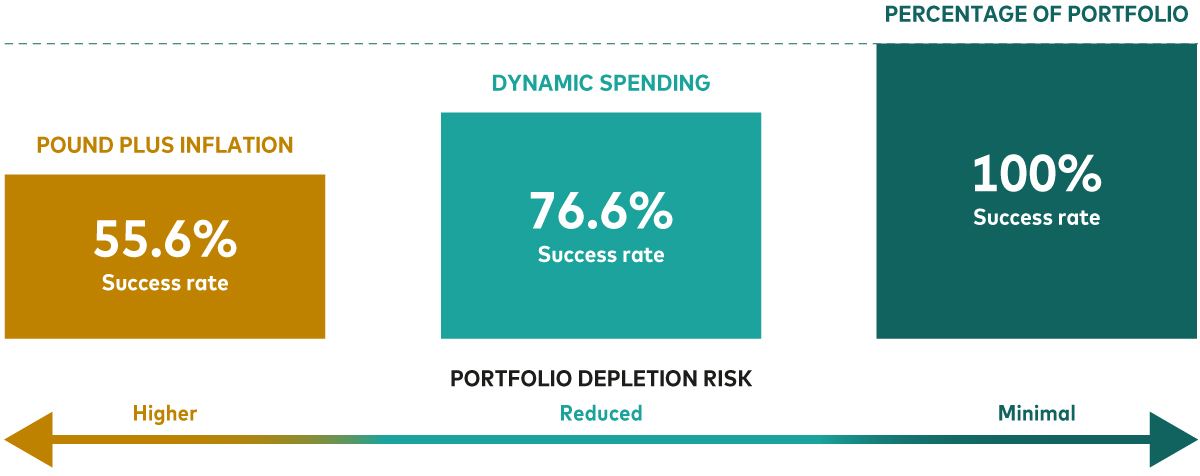

To analyse how dynamic spending compares with other spending approaches, we projected the returns of a hypothetical £1 million 50% stock/50% bond portfolio over a 30-year time horizon using an initial withdrawal rate of 5.5%. We then analysed how the portfolio would fare when applying each of the spending strategies outlined in this article.

First, we looked at longevity risk – or the risk of prematurely depleting the portfolio. By definition, the percentage-of-portfolio approach will always last the entire period (this is the mathematics of withdrawing a percentage less than 100% each year), so this is reflected in the result. The pound-plus-inflation approach had a more modest chance of success in lasting the 30 years, achieving this 55.6% of the time. The dynamic spending approach, however, provided a material improvement, achieving success 76.6% of the time.

Looking at this another way, to achieve an 85% chance of being successful, using the pound-plus-inflation approach, the initial withdrawal rate was set at 4.57%. However, the dynamic spending approach enabled an initial withdrawal rate which was meaningfully higher at 5.19%. This represents an increase of around 14%.

Delivering on portfolio longevity

Success Rate on an ‘initial’ portfolio withdrawal rate of 5.5.% (or £55,000 on a portfolio value of £1,000,000)

Notes: This hypothetical illustration does not represent the investment results of any particular portfolio. All results are based on 10,000 VCMM simulations as of December 2024 using the indicated spending rule. See Appendix for more information on VCMM. Analysis assumes a portfolio allocation of 50% stocks (5% UK, 95% International) and 50% bonds (5% UK, 95% International), a time horizon of 30 years, and an 'initial portfolio withdrawal rate' of 5.5%. UK and Global bonds represented by Bloomberg Barclays UK Aggregate Index and Global Aggregate Index GBP hedged; UK and global equities represented by MSCI UK Index and World Index GBP. Dynamic spending rule utilizes a 5% ceiling and a 1.6% floor.

Source: Vanguard.

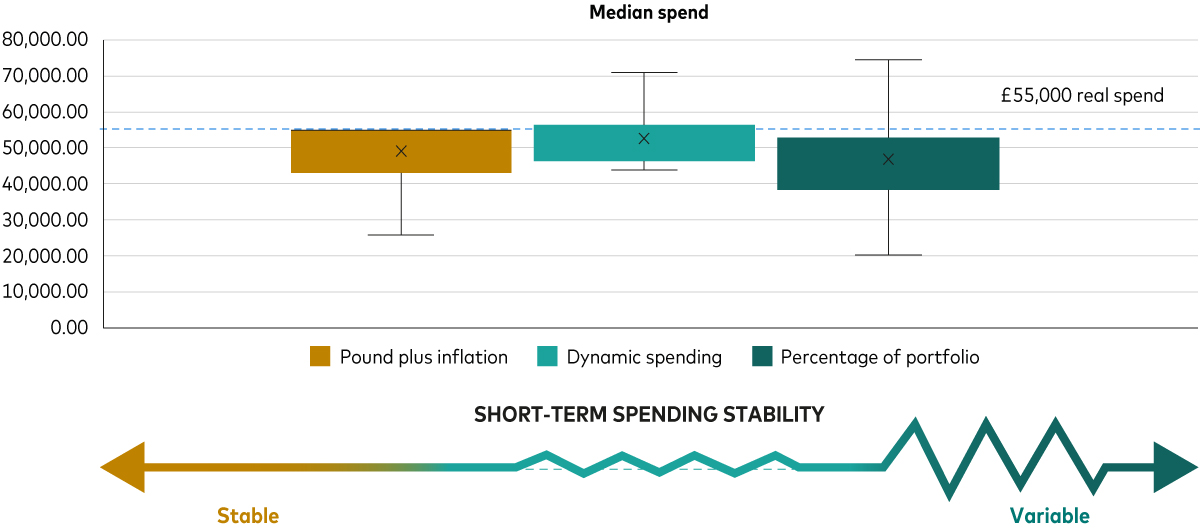

When we looked at spending stability across our simulations, the percentage-of-portfolio approach offered the least stability (which is to be expected, given expenditure will be linked to market returns). The pound-plus-inflation portfolio also delivered considerable variability in spending budgets because many of the scenarios measured (around 44%) resulted in premature depletion of the portfolio, meaning spending fell to zero. On the other hand, dynamic spending provided the better spending stability across the various scenarios compared to the other two spending approaches.

Delivering on portfolio stability

Success Rate on an ‘initial’ portfolio withdrawal rate of 5.5.% (or £55,000 on a portfolio value of £1,000,000)

Notes: This hypothetical illustration does not represent the investment results of any particular portfolio. All results are based on 10,000 VCMM simulations as of December 2024 using the indicated spending rule. See Appendix for more information on VCMM. Analysis assumes a portfolio allocation of 50% stocks (5% UK, 95% International) and 50% bonds (5% UK, 95% International), a time horizon of 30 years, and an 'initial portfolio withdrawal rate' of 5.5%. UK and Global bonds represented by Bloomberg Barclays UK Aggregate Index and Global Aggregate Index GBP hedged; UK and global equities represented by MSCI UK Index and World Index GBP. Dynamic spending rule utilizes a 5% ceiling and a 1.6% floor.

Source: Vanguard.

In summary, we believe a dynamic spending strategy can help retired investors weather the effects of market shocks on their portfolios while helping them preserve a reasonable level of income to meet their spending goals. For the right client, where they do have some flexibility in their expenditure, it can be an opportunity to target a higher spending amount while still helping to mitigate the risk of portfolio depletion.

Regardless of the spending strategy, the changing market conditions and clients' evolving needs during retirement highlight the ongoing value of skilled, knowledgeable advice.

For more information and guidance on dynamic spending, please contact your local Vanguard representative.

1 Baby boomers are defined as 61 to 65 year olds in full-time employment.

2 Target replacement rates were established by the Pensions Commission in 2004-05 and then uprated to 2024-25 values by the Resolution Foundation.

3 See How to estimate likely Retirement Living Standards. PLSA, 2023.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This is directed at professional investors and should not be distributed to, or relied upon by retail investors.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offe\r or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.