For most investors, achieving long-term financial goals doesn’t have to be complicated. Studies have found, time and time again, that a strategic allocation to global equities and global bonds gives long-term investors a good chance of success1.

In this article, we explore the key benefits of employing a strategic approach to asset allocation relative to tactical approaches, and how strategic asset allocation can be used effectively to help clients achieve long-term investment success.

What do we mean by strategic asset allocation?

Strategic asset allocation involves the deliberate division of investments across different asset classes to manage risk while targeting either a specific or broad long-term investment objective-and rebalancing the portfolio back to this pre-set allocation periodically. By spreading investments across assets with different risk and return expectations and characteristics, strategic multi-asset portfolios seek to leverage the benefits of diversification* to help investors meet their long-term return objectives.

There are two primary approaches to strategic asset allocation: fixed-target allocation (steady), whereby the proportion invested in global equities and global bonds is consistent and maintained through regular portfolio rebalancing; and time-varying allocation (dynamic), whereby the mix of assets changes over time to optimise portfolio returns according to the portfolio’s objective.

Investors with a broad, long-term growth objective are typically well-served by a steady allocation to global equities and bonds that is commensurate with their goals, investment horizon and preferences around risk. For example, for an investor with a long investment horizon and relatively high tolerance for risk, a steady allocation of 80% equities and 20% bonds might be best-suited. An investor with a lower risk tolerance might be better served with a 60% or 40% allocation to equities and the remainder invested in global bonds.

Investors with a specific investment objective, such as an annual return or volatility target, might be better served by a time-varying approach to asset allocation. Dynamic asset allocation involves changing the target mix of assets at a pre-determined time using the latest long- and medium-term return forecasts.

A range of dynamic allocation portfolios might include different return targets, such as 4%, 6% and 8%, for example, and the optimal asset allocation would differ for each target. In this example, the portfolio with a 4% return target would take a more defensive approach to asset allocation relative to the 6% and 8% target portfolios. Alternatively, rather than a specific target, dynamic allocation strategies might be guided by a client’s preferences towards risk, and might involve categorising allocations as high risk, moderate risk and conservative, for example.

The risks of strategic and tactical allocation

A key difference between steady and dynamic allocation strategies is the type of risk an investor takes on. With a steady allocation, portfolios don’t adapt to medium-term changes in market expectations, which can test an investor’s discipline during weak or volatile markets. For example, a sharp change in interest-rate expectations can significantly influence medium- and long-term return forecasts, as well as short-term market movements.

While dynamic allocation strategies can adapt to shifting market environments, they do take on active risk in the form of model-based asset allocation changes relative to a static benchmark. Put simply, there is a chance that the shift in allocation could result in underperformance relative to a steady allocation portfolio.

Whether fixed-target or time-varying, strategic multi-asset solutions target a level of risk and reward to help investors meet their goals over the long term. By understanding the relative benefits of both approaches, advisers can help guide clients towards the strategy that best aligns with their individual goals and circumstances.

An alternative method to maintain a multi-asset portfolio is a tactical approach. Unlike a strategic approach, tactical asset allocation encourages adjustments to a portfolio’s asset mix based on short-term market forecasts. This approach aims to systematically exploit perceived inefficiencies or temporary imbalances in values among different assets or sub-asset classes.

Although tactical allocation decisions might sound like a good way to deal with changes in market conditions, they are very difficult to get right consistently and can actually risk putting investors further away from their long-term goals.

The tactical allocation trap

There’s a reason why market-timing is so difficult. When we analyse the steps that make a tactical move successful, investors need to get all five of these different decisions right for each tactical shift in allocation to succeed:

Correctly identify a reliable indicator of short-term future market returns.

Correctly time the exit from an asset class or the market.

Correctly time re-entry to an asset class or the market.

Decide on the appropriate size of the allocation and how to fund the trade.

Successfully execute the trade such that the expected benefit exceeds the cost of the trade.

Not only would investors have to be right on all five points above, they would have to repeat this success for most of their trades to make an impact, and even then the impact would likely be marginal.

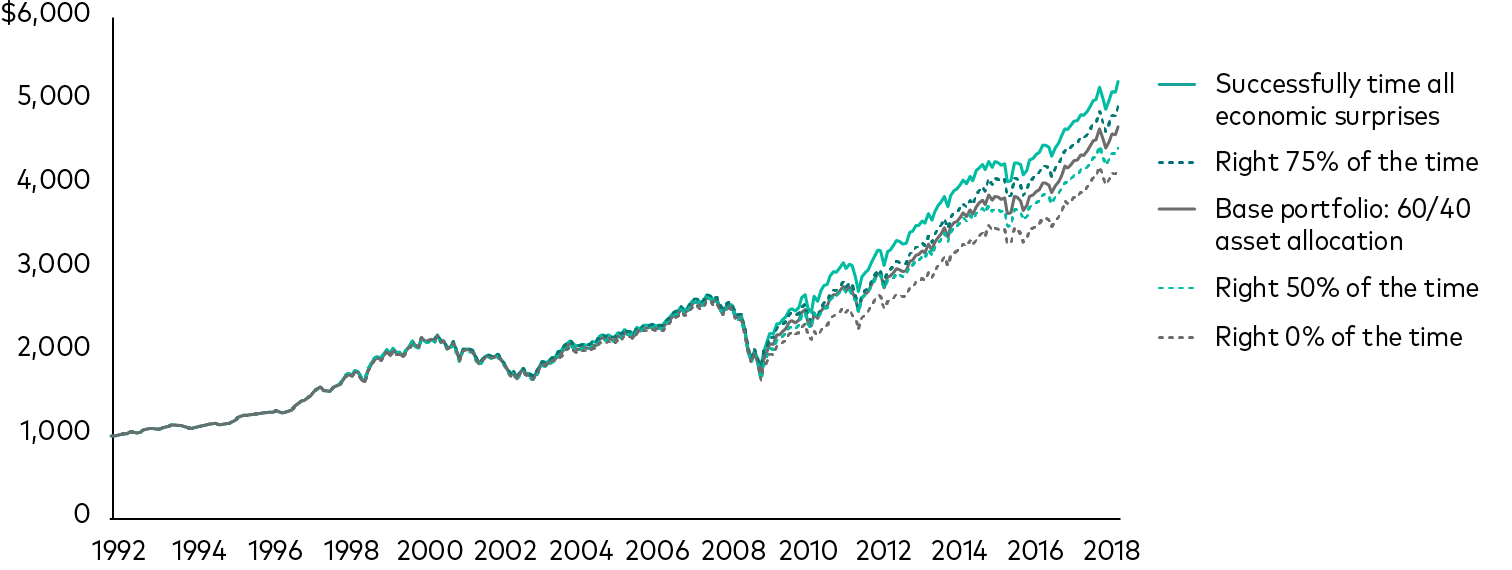

The chart below shows that if investors successfully anticipated economic surprises all of the time, their annualised return over more than 25 years would only be 0.2 percentage point higher than a steady allocation portfolio of 60% US stocks and 40% US bonds. An investor who was correct 75% of the time would have a final balance only $252 greater than the base portfolio after 26 years. And an investor who was correct half the time (the equivalent of a coin toss) would have underperformed the base portfolio. This illustration uses historic market performance data for a US portfolio, but the findings are pertinent for UK-based investors too.

Growth of $1,000 based on how successful investors were in anticipating economic surprises

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Vanguard paper Here Today, Gone Tomorrow: The Impact of Economic Surprises on Asset Returns, November 2018. Vanguard calculations using data from the U.S. Bureau of Economic Analysis, the U.S. Bureau of Labor Statistics, Bloomberg, and Refinitiv.

Notes: The MSCI USA Index and the Bloomberg U.S. Aggregate Bond Index were used as proxies for US stocks and US bonds. The chart represents the growth of hypothetical portfolios with initial balances of $1,000 as at 1 January 1992, growing until 31 August 2018. Significant changes in nonfarm payrolls were used as economic surprises. The hypothetical investors would change the asset allocation to either 80% stocks and 20% bonds in anticipation of a positive economic surprise, or to 40% stocks and 60% bonds in anticipation of a negative surprise. Trading costs were not factored into the scenarios; if they had been, the returns of the tactical portfolios would have been lower. Returns calculated in USD with income reinvested.

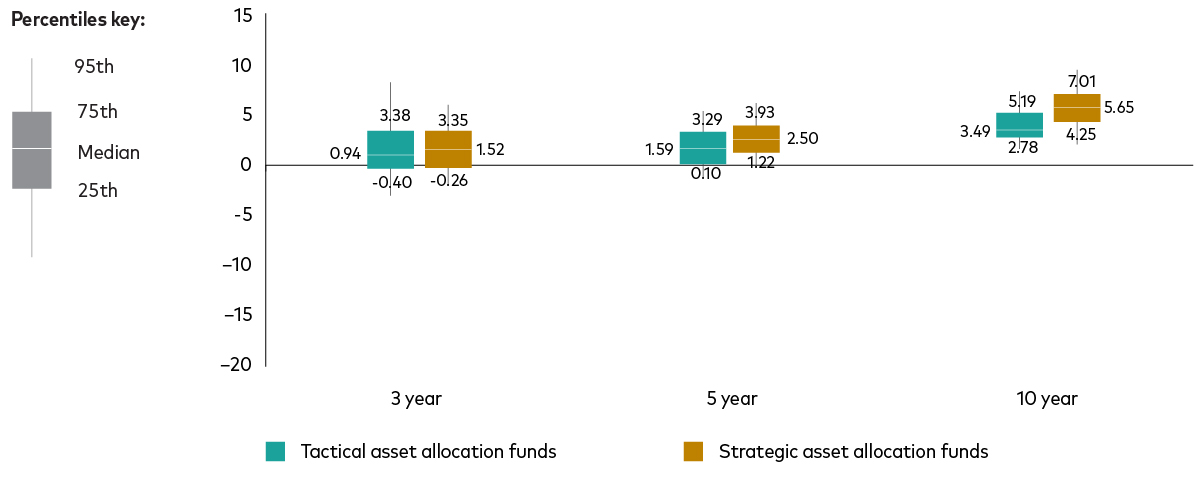

Even professional asset managers find it challenging to correctly time the market. The next chart shows how tactical allocation funds had a lower median return and greater distribution of outcomes than strategic allocation counterparts over three-, five- and 10-year periods. In other words, tactical funds take more risk than strategic funds – and often they get it wrong.

Distribution of returns for strategic versus tactical funds over different time periods

Past performance is no guarantee of future returns.

Source: Vanguard calculations using Morningstar data from 31 December 2012 to 31 December 2022.

Notes: Based on the performance of the oldest share class for funds assigned to the following Morningstar categories: Tactical: EAA Fund GBP Flexible Allocation; Strategic: EAA Fund GBP Allocation 0-20% Equity, EAA Fund GBP 20-40% Equity, EAA Fund GBP Allocation 40-60% Equity, EAA Fund GBP Allocation 60-80% Equity and EAA Fund GBP Allocation 80%+ Equity. Only funds with a Global Investment area available for sale in the UK are considered. Performance data are based on total annualised returns, income reinvested, net of fees. All figures in GBP.

Helping clients get closer to their goals

Given the importance of asset allocation in helping investors achieve their long-term goals, identifying the appropriate strategy for clients is arguably among one of the most important investment interventions an adviser will make.

Whether advisers construct multi-asset portfolios for clients manually or use an all-in-one multi-asset solution, the most suitable strategy will depend on the investor’s investment goals, time horizon and preference for risk.

For most investors, a fixed-target, steady allocation to global equities and global bonds that aligns with their individual goals and risk tolerance has historically delivered value over the long term. For investors with more specific investment needs or who are willing to tolerate a certain level of model risk, a time-varying approach to asset allocation may be more suitable.

Broadly speaking, clients with longer-term horizons may be better suited to higher equity market allocations of, say, 80% or 100%, so either a fixed allocation strategy of 80% or 100% equity would be suitable, or a time-varying strategy with high equity allocation guard rails.

Investors with a shorter timeframe – such as clients who have begun or are approaching retirement – may be more suited to a 40% or 20% equity allocation, with global bonds making up the majority of the portfolio.

Key takeaways

Strategic asset allocation involves deliberately dividing investments across different asset classes to manage risk while targeting a long-term investment objective.

Two primary approaches to strategic asset allocation are fixed-target allocation (steady) and time-varying allocation (dynamic).

Tactical asset allocation strategies, which allow adjustments to a portfolio’s asset mix based on short-term market forecasts, are difficult to get right consistently and have underperformed strategic allocation solutions over the long term.

Fixed-target allocation (steady) is typically best suited for broad, long-term growth objectives, while time-varying allocation (dynamic) is better for specific long-term investment objectives.

Successfully execute the trade such that the expected benefit exceeds the cost of the trade.

1 For example, see Gary P. Brinson, L. Randolph Hood, and Gilbert L. Beebower, 1995. ‘Determinants of portfolio performance.’ Financial Analysts Journal 51(1):133–8. (Feature Articles, 1985–1994).

*The diversification benefit of holding different asset classes is commonly measured by the correlation between their returns. A high return correlation, over the long-term, would offer little diversification benefit to a portfolio, because it means the returns of the two asset classes tend to move in the same direction. A low or negative return correlation offers better diversification and helps to reduce risk. This applies at the asset and sub-asset class levels. Greater diversification generally translates to less volatility.

For example, since the late 1990s, the long-term return correlation between global equity and bond markets has been negative. This has fuelled demand for traditional multi-asset solutions that invest in a mix of equities and bonds – sometimes referred to as the 60/40 model, owing to the historic popularity of investing 60% in equities and 40% in bond markets. Global equities have tended to drive the majority of returns in 60/40 portfolios, while global bonds have typically provided a buffer against equity market risk – along with an income return. We explore the dynamics of stock/bond correlations in greater depth in this article.

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizOther Vanguard 365 pillars

Client relationships

CPD content crafted to empower you to service your client’s needs effectively, build relationships, create loyalty and achieve new business growth.

Practice management

CPD content designed to help you build your practice, market your services effectively and cultivate a thriving professional network.

Financial planning

CPD content structured to give you access to useful tools, guides and multimedia resources covering diverse topics from risk profiling to retirement planning.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

The information contained in this article is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

© 2025 Vanguard Asset Management, Limited. All rights reserved.

Vanguard Asset Management, Limited is authorised and regulated in the UK by the Financial Conduct Authority.