Why use Vanguard ActiveLife Climate Aware?

Vanguard has been offering multi- asset solutions in conjunction with Wellington since 1975 and today manages more than £1,507 bn (1) for multi-asset investors around the world.

Climate considerations

Incorporates ESG criteria, including a net zero commitment, helping to build a long-term competitive advantage that aims to deliver long-term growth.

Multi asset

Provides an all-in-one portfolio of equities and bonds that is highly diversified across geographies, sectors and investment styles.

Proven expertise

Vanguard and Wellington have a long history in multi-asset investing. Wellington's expertise in multi-asset investing dates back to 1929.

Low cost

The Ongoing Charges Figure (2) of the ActiveLife Climate Aware range is 0.48%, which is significantly below the 1.02% average expense ratio of the category (3).

(1) Source: Vanguard, as at 31 December 2024.

(2) The ongoing charges figure/total expense ratio (OCF/TER) covers administration, audit, depository, legal, registration and regulatory expenses incurred in respect of the funds.

(3) Source: Morningstar, as at 15 November 2024.

Net zero 2050 commitment

The Vanguard ActiveLife Climate Aware funds have a 2050 net zero emissions target in alignment with the Paris Agreement to limit global warming to well below 2°C.

A choice of three funds

Vanguard offers a range of high-quality investment funds to help you meet your financial goals as well as reflect your ESG preferences.

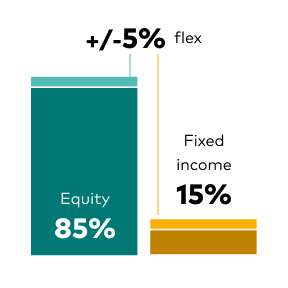

ActiveLife Climate Aware 40-50% Equity Fund

For investors with a lower tolerance for risk

ActiveLife Climate Aware 60-70% Equity Fund

For investors with a moderate tolerance for risk

ActiveLife Climate Aware 80-90% Equity Fund

For investors with a higher tolerance for risk

ActiveLife Climate Aware

Net-zero commitment: The fund manager aims to invest a proportion of the fund’s shares and corporate bonds in companies with net-zero science-based targets to reduce greenhouse-gas emissions (4).

Climate Considerations: The fund manager looks to invest a proportion of the fund's shares and corporate bonds in companies which display qualities that support their journey towards net zero. When the fund manager purchases government bonds for the fund, the fund manager will consider whether the country's carbon intensity is at least 25% lower than the average of the government bonds issued by other countries within the benchmark index.

Exclusions policy: The fund manager excludes companies involved in and/or deriving revenue (5) from tobacco, thermal coal, oil sands and nuclear/controversial weapons. When the fund manager purchases government bonds for the fund, the fund manager will ensure that the fuel exports for the relevant country do not exceed 50% of total exports.

Engagement with companies: The fund manager will engage with certain companies to encourage improvements in their paths to net zero by 2050. Engagement activities might include meeting with company boards, engagement with non-executive directors and participating in stakeholder dialogues.

(4) Net-zero science-based targets are targets that provide a way for companies to reduce their greenhouse-gas emissions. They are considered to be ‘science-based’ if they are in line with what scientists deem is necessary to meet the goals of the Paris Agreement. This is an international treaty to limit global warming to well below 2 degrees C above pre-industrial levels and to pursue efforts to limit global warming to 1.5 degrees C above pre-industrial levels. The fund managers aim to invest 50% of the fund’s shares and corporate bonds in companies with these targets by 2027, rising to 60% by 2030, 90% by 2040 and 100% by 2050.

(5) Revenue above certain thresholds, as determined by the external manager of the fund according to the manager’s exclusions policy.

Documents for you and your clients

Vanguard multi-asset solutions

Our multi-asset funds and model portfolios can provide access to thousands of underlying equities or bonds in a single, ready-made portfolio.

Build on your multi-asset knowledge and earn 30 minutes of CPD

Expand your understanding of the role multi-asset solutions can have in achieving your client objectives with our “Streamlining with multi-asset” module, part of Vanguard 365, our continual learning solution for advisers.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Investments in smaller companies may be more volatile than investments in well-established blue chip companies.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The fund may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund’s net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

This document is designed for use by, and is directed only at persons resident in the UK.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares of, and the receipt of distribution from any investment.

The Authorised Corporate Director for Vanguard Investments Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard Investments Funds ICVC.

For investors in UK-domiciled funds, a summary of investor rights can be viewed here and is available in English.